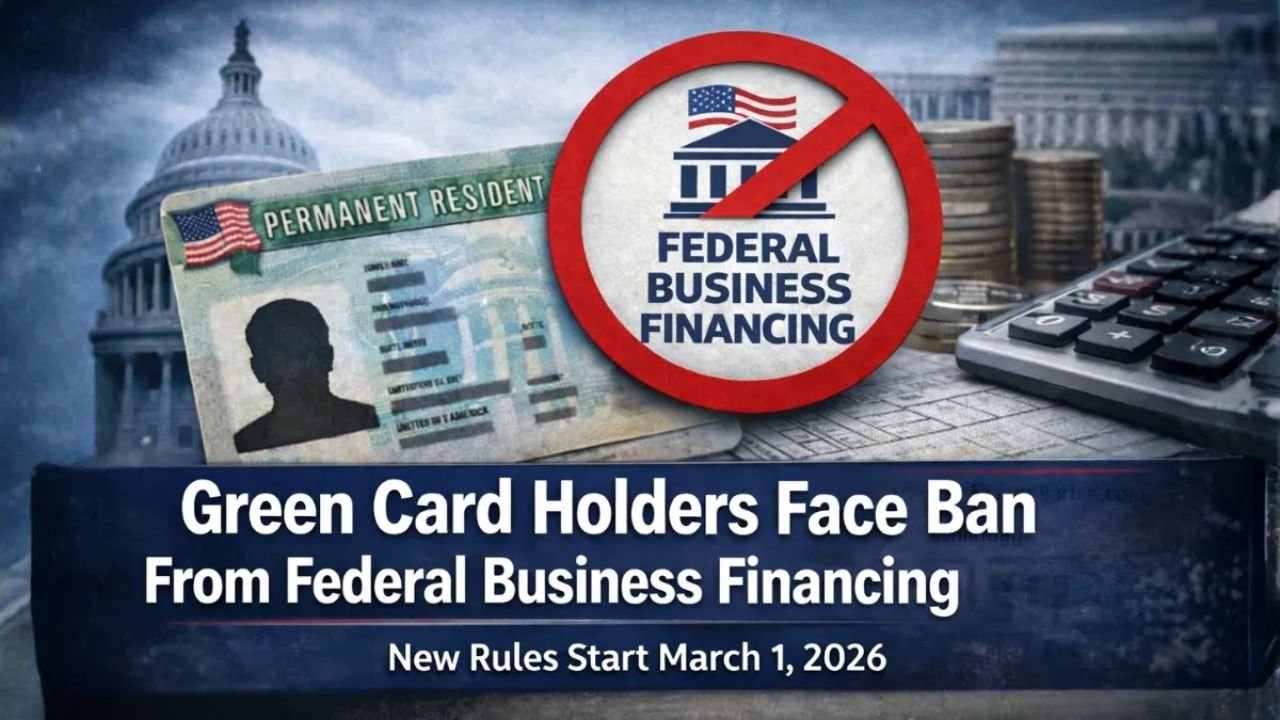

Official Policy Shift: Green Card Holders Face Restrictions on Federal Business Financing in 2026

A newly confirmed federal policy update is set to reshape access to government-backed business financing in 2026. Under the revised rules, lawful permanent residents — commonly known as Green Card holders — will face new restrictions when applying for certain federally supported business loan programs.

The announcement marks a meaningful change in eligibility standards and is already generating discussion among immigrant entrepreneurs, lenders, and financial advisors. While the policy does not affect immigration status, it alters how citizenship is factored into access to specific taxpayer-backed financing tools.

Here’s what the change means, which programs may be affected, and how business owners can prepare.

What the Policy Change Officially Confirms

The updated policy narrows eligibility for select federal business financing programs by prioritizing U.S. citizens. Green Card holders, despite their lawful permanent resident status, may no longer qualify for certain government-guaranteed loan programs moving forward.

Importantly:

- Lawful permanent residency rights remain intact

- Work authorization for Green Card holders is unchanged

- The restriction applies specifically to designated federal financing programs

The shift reflects a tightening of citizenship-based eligibility criteria rather than a change in immigration law.

Which Federal Business Loans May Be Affected

The restriction is expected to apply primarily to business loans and loan guarantees that are backed or insured by federal agencies. Programs administered through entities such as:

- The Small Business Administration (SBA)

- Federal credit guarantee programs

- Government-backed expansion or development financing initiatives

may introduce enhanced citizenship verification requirements.

Private bank loans that are not federally guaranteed are not covered by this change. Traditional commercial lending, venture capital funding, and private investment channels remain available to lawful permanent residents.

Why the Government Introduced the Change

Officials have cited several reasons for the revised eligibility standards:

Fiscal Accountability

Federal loan guarantees expose taxpayer funds to potential financial risk. Policymakers argue that restricting eligibility to U.S. citizens aligns with updated budget priorities.

National Economic Policy Goals

The administration has emphasized directing federal financial support toward citizen-owned enterprises under revised economic development objectives.

Oversight and Compliance Controls

Stricter eligibility screening is also framed as a method to streamline compliance and reduce administrative complexity.

While the rationale centers on fiscal and policy priorities, critics note that Green Card holders contribute significantly to the U.S. economy through entrepreneurship and job creation.

The Potential Impact on Immigrant Entrepreneurs

Lawful permanent residents have long been active participants in small business ownership across sectors including technology, healthcare, retail, hospitality, and manufacturing.

The new financing restriction may create several challenges:

- Reduced access to lower-interest, government-backed loans

- Higher borrowing costs through private lenders

- Stricter underwriting standards outside federal programs

- Slower expansion timelines for capital-intensive businesses

Government-backed loans often offer favorable terms, including extended repayment periods and lower down payments. Losing access to those benefits may require entrepreneurs to restructure funding strategies.

However, it is important to note that the policy does not prohibit Green Card holders from owning, operating, or expanding businesses in the United States.

What Remains Unchanged

Despite the policy shift, several critical areas remain unaffected:

- Lawful permanent residents retain full authorization to start and operate businesses

- Existing approved federal loans are not automatically revoked

- Private-sector lending options remain fully accessible

- Venture capital and investor funding pathways continue as before

The restriction applies prospectively to eligibility for certain federal financing programs rather than retroactively altering previously approved agreements.

Strategic Steps for Affected Business Owners

Green Card holders who may be impacted should consider proactive financial planning.

Review Current Loan Agreements

If you already have a federally backed loan, confirm whether your agreement is subject to any future changes. In most cases, previously approved financing remains valid.

Monitor Official Agency Guidance

Federal agencies are expected to release updated eligibility criteria and implementation timelines. Staying informed ensures you can adjust funding plans early.

Explore Alternative Financing Options

Private funding channels may include:

- Commercial bank loans

- Credit union financing

- Angel investors and venture capital

- Revenue-based financing

- Strategic partnerships

Diversifying capital sources can reduce reliance on government-backed programs.

Strengthen Financial Documentation

Private lenders may apply stricter underwriting standards. Maintaining strong financial statements, clean credit records, and detailed business plans improves approval odds.

Broader Economic Considerations

Immigrant-founded businesses have historically contributed significantly to innovation, job creation, and regional economic growth. Policy shifts affecting financing access may influence entrepreneurial activity patterns.

Financial analysts suggest that while the change may increase short-term funding friction for some founders, capital markets remain robust. Private-sector financing ecosystems continue to expand, particularly in high-growth industries.

Ultimately, access to capital will depend on creditworthiness, business fundamentals, and lender appetite rather than residency classification alone.

Looking Ahead

The 2026 policy update signals a recalibration of federal financing eligibility standards rather than a wholesale restructuring of business ownership rights.

For Green Card holders, the path to entrepreneurship remains open. However, navigating funding options may require greater reliance on private capital and strategic financial planning.

Entrepreneurs are encouraged to consult qualified financial advisors or legal professionals for guidance tailored to their specific situation.

Final Thoughts

The confirmed 2026 policy change introduces citizenship-based restrictions on select federal business financing programs, affecting some Green Card holders seeking government-backed loans. While lawful permanent residency rights remain intact, access to certain taxpayer-supported financing tools will be limited under the revised rules.

Understanding the scope of the change, monitoring agency updates, and preparing alternative funding strategies will be essential for immigrant entrepreneurs moving forward.

Disclaimer: Federal financing policies, eligibility standards, and implementation timelines are subject to official agency guidance. Business owners should rely on authorized government notices and professional financial or legal advice for binding information.