For millions of Americans, Social Security payments are more than routine deposits — they are the foundation of monthly financial stability. As February 2026 progresses, many beneficiaries are closely watching their accounts, particularly those expecting payment on February 12.

Understanding exactly who gets paid on that date — and why — can help retirees, SSDI recipients, and survivor beneficiaries manage cash flow with confidence. Here is a complete breakdown of how the Social Security payment schedule works in February 2026 and what recipients should expect.

How the Social Security Payment Schedule Is Structured

The Social Security Administration (SSA) operates on a carefully organized monthly payment calendar. Rather than issuing all payments at once, the agency distributes benefits across multiple Wednesdays each month.

This staggered structure helps:

- Reduce processing congestion

- Prevent system overload

- Ensure consistent and timely deposits

- Improve nationwide payment reliability

For most retirement, Social Security Disability Insurance (SSDI), and survivor beneficiaries, payment dates are based on birth dates.

Standard Wednesday Payment System

The typical monthly schedule works as follows:

- Birthdays between the 1st and 10th: Paid on the second Wednesday

- Birthdays between the 11th and 20th: Paid on the third Wednesday

- Birthdays between the 21st and 31st: Paid on the fourth Wednesday

This predictable system allows recipients to anticipate their deposits well in advance.

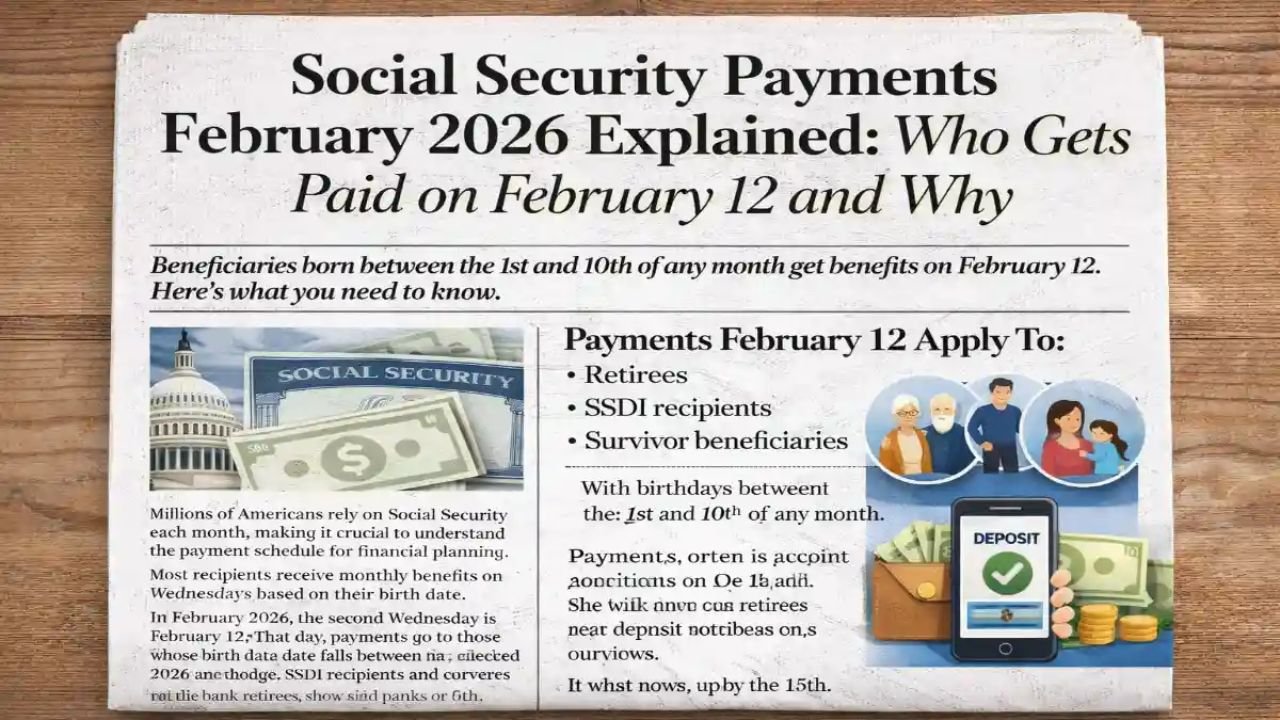

Who Gets Paid on February 12, 2026?

In February 2026, February 12 falls on the second Wednesday of the month.

This means beneficiaries whose birthdays fall between the 1st and 10th of any month are scheduled to receive their Social Security payment on February 12.

Eligible recipients include:

- Retired workers receiving Social Security retirement benefits

- SSDI beneficiaries

- Survivor benefit recipients

If your birthday falls within that range and you began receiving benefits after May 1997, February 12 is your scheduled payment date for the month.

Who Is Paid on Other February Dates?

Not all Social Security beneficiaries are paid on February 12. Other groups follow different Wednesdays based on birth date.

Third Wednesday – February 19, 2026

Recipients born between the 11th and 20th are typically paid on the third Wednesday.

Fourth Wednesday – February 26, 2026

Recipients born between the 21st and 31st are usually paid on the fourth Wednesday.

This staggered schedule continues every month throughout the year, offering predictability for financial planning.

Special Payment Schedules to Know

Certain beneficiaries do not follow the standard Wednesday structure.

Beneficiaries Receiving Benefits Before May 1997

Individuals who began receiving Social Security before May 1997 typically receive their payment on the 3rd of each month, regardless of birth date.

If the 3rd falls on a weekend or federal holiday, payment is generally issued on the preceding business day.

Supplemental Security Income (SSI) Recipients

SSI benefits are usually paid on the 1st of each month. If the 1st falls on a weekend or holiday, payments are sent on the last business day before that date.

Some individuals who receive both SSI and Social Security benefits may receive two separate deposits each month on different dates.

How Social Security Payments Are Delivered

Today, the vast majority of Social Security payments are sent electronically. Direct deposit is the default method and remains the fastest and most secure option.

Direct Deposit

- Funds are deposited directly into a bank or credit union account

- Payments typically appear on the scheduled date

- Some financial institutions may post funds slightly early

Direct Express Debit Card

Beneficiaries without traditional bank accounts may receive funds via the Direct Express prepaid debit card system.

Paper Checks (Rare)

Paper checks are far less common and may take additional time due to mailing and processing delays.

Electronic delivery significantly reduces the risk of lost payments and improves overall efficiency.

Why the SSA Uses a Birth-Date System

The birth-date payment model was introduced to modernize and streamline benefit distribution. With tens of millions of Americans receiving monthly payments, spreading deposits across multiple Wednesdays helps maintain operational stability.

Key advantages of the system include:

- Balanced processing workload

- Reduced payment bottlenecks

- Enhanced accuracy in deposit timing

- Greater reliability during high-volume periods

This structured approach has proven effective in maintaining consistent nationwide payment delivery.

What to Do If Your February 12 Payment Does Not Arrive

Although most payments arrive on time, occasional delays can occur due to banking procedures or technical issues.

If your payment does not appear on February 12:

- Wait at least three business days before taking action

- Check with your financial institution to confirm pending deposits

- Verify that your banking information on file is accurate

- Contact the Social Security Administration if the issue persists

Keeping personal and banking details up to date significantly reduces the risk of delays.

Financial Planning Around Payment Dates

Understanding your Social Security payment date allows for better monthly budgeting. Many recipients align bill payments, mortgage installments, or utility expenses with their scheduled deposit date.

If February 12 is your payment day, consider:

- Scheduling automatic bill payments after deposit confirmation

- Reviewing your monthly cash flow strategy

- Building an emergency buffer when possible

- Monitoring account activity for accuracy

Financial clarity begins with knowing when your income arrives.

Final Thoughts

The February 12, 2026 Social Security payment applies primarily to retirees, SSDI recipients, and survivor beneficiaries born between the 1st and 10th of the month who began receiving benefits after May 1997.

The SSA’s structured, birth-date-based system ensures smooth and predictable benefit distribution across the country. By understanding how the schedule works, beneficiaries can plan expenses with confidence and avoid unnecessary concern about payment timing.

Staying informed about your designated payment date is one of the simplest ways to maintain financial stability throughout 2026.