$2,000 Direct Deposit Update for February 2026: Eligibility Rules, Timeline, and a Practical Reality Check

As February 2026 approaches, online discussions about a potential $2,000 direct deposit have gained significant attention. Headlines and social media posts suggest a new federal payout may be on the way. For many households navigating rising costs and financial planning decisions, the idea of an additional deposit is understandably appealing.

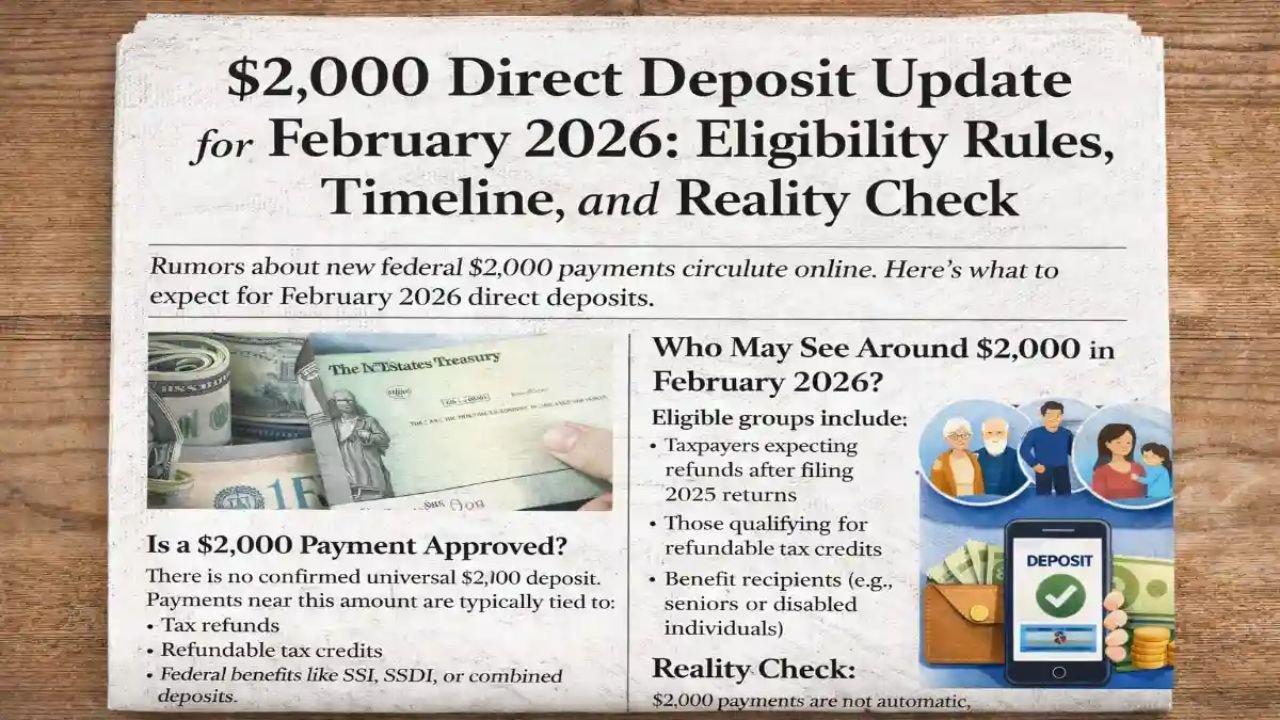

However, clarity is essential. At this time, there is no confirmed universal $2,000 federal payment scheduled for all U.S. residents in February 2026. What many people are seeing instead are regular federal deposits — tax refunds, benefit payments, and refundable credits — that may total around $2,000 depending on individual eligibility.

Here is a detailed breakdown of what is actually happening, who may qualify for deposits in this range, and how to separate financial fact from speculation.

Is There a New $2,000 Stimulus Payment?

No new legislation has established a blanket $2,000 direct deposit for every American in February 2026. Any nationwide stimulus program would require formal congressional approval and official announcement through federal agencies such as the U.S. Treasury and the Internal Revenue Service (IRS).

Currently, federal payment activity in February reflects standard seasonal processes, including:

- Income tax refunds for the 2025 tax year

- Refundable tax credit payments

- Monthly Social Security benefits

- Supplemental Security Income (SSI) deposits

- Social Security Disability Insurance (SSDI) payments

The $2,000 figure circulating online often represents estimated refund averages or combined benefit totals rather than a newly approved universal payout.

Who Could Receive Around $2,000 in February 2026?

While there is no automatic payment for everyone, certain individuals may see deposits near or above $2,000 depending on their circumstances.

Taxpayers Receiving Refunds

Many Americans filing their 2025 federal tax returns may receive refunds in the $2,000 range. Refund amounts vary based on:

- Income level

- Tax withholding throughout the year

- Filing status

- Eligibility for credits

- Deductions claimed

For households with dependents or qualifying refundable credits, refunds can exceed this amount. Others may receive less depending on their tax profile.

Refundable Tax Credit Recipients

Credits such as the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) can significantly increase refund totals. These credits are designed to support working families and may push refunds toward or beyond $2,000.

However, eligibility rules apply, and payment timing may differ due to verification procedures.

Social Security and Federal Benefit Recipients

Seniors and individuals receiving SSDI or SSI benefits may see deposits approaching $2,000 depending on their monthly benefit amount and whether multiple payments align within the same month.

For example, retirees with higher lifetime earnings may receive monthly benefits near or above this figure. In some cases, cost-of-living adjustments increase benefit totals year over year.

Each payment reflects an individual’s earnings history and program eligibility — not a new stimulus measure.

February 2026 Payment Timeline Explained

Understanding how federal deposits are processed helps clarify expectations.

Tax Refund Timeline

For electronically filed returns, the IRS generally aims to issue refunds within approximately 21 days after acceptance. The timeline typically unfolds as follows:

- Return filed and accepted

- Processing and verification

- Refund approved

- Refund sent via direct deposit

Taxpayers who file early, submit accurate information, and choose direct deposit are usually paid first.

Paper-filed returns take longer, often extending into several weeks or more before refunds are issued.

Social Security and Benefit Schedules

Social Security and SSDI payments follow fixed monthly schedules. Payment dates depend on birth dates and program categories. These deposits are predictable and structured, not surprise distributions.

Funds are typically deposited electronically and appear within one to three business days after processing, depending on the financial institution.

Why the $2,000 Claim Is Circulating

Online confusion often stems from combining multiple financial elements into a single headline figure.

Common sources of misunderstanding include:

- Average refund estimates being interpreted as guaranteed payments

- Combining monthly benefits with tax refunds

- Referencing past stimulus amounts from previous years

- Viral posts lacking official confirmation

While the number may reflect what some individuals receive under existing programs, it does not represent a new universal initiative.

Clear communication matters, particularly when financial planning decisions are involved.

How to Verify Legitimate Federal Payments

Relying on verified information protects against misinformation and unrealistic expectations. To confirm payment details:

- Monitor official IRS updates for tax refund processing

- Review Social Security Administration payment schedules

- Access secure government portals for status tracking

- Avoid sharing personal information through unverified sources

Official agencies do not announce stimulus payments exclusively through social media posts or third-party websites.

How to Avoid Delays in Receiving Eligible Funds

If you are expecting a tax refund or federal benefit deposit in February 2026, proactive steps can ensure smooth processing.

File Electronically

E-filing reduces errors and accelerates IRS acceptance.

Choose Direct Deposit

Electronic transfers remain the fastest and most secure method of receiving funds.

Double-Check Banking Information

Incorrect routing or account numbers are among the most common causes of delayed payments.

Respond Promptly to Verification Requests

If identity confirmation or additional documentation is required, timely response prevents extended processing delays.

Financial efficiency begins with accurate documentation.

The Financial Planning Perspective

For many households, a deposit near $2,000 can represent an opportunity — whether for building savings, reducing high-interest debt, investing, or covering planned expenses.

However, planning based on confirmed eligibility rather than online speculation is critical. Budgeting decisions should rely on documented refund amounts or scheduled benefit payments, not headline assumptions.

Maintaining flexibility in financial planning provides resilience during tax season and beyond.

The Reality Check

There is no confirmed universal $2,000 direct deposit scheduled for February 2026. What is occurring is the regular distribution of tax refunds and federal benefits according to established systems.

Some Americans will receive deposits around this amount. Others may receive more or less. The variation depends entirely on individual eligibility, income history, and filing accuracy.

Understanding the structure behind federal payments prevents unnecessary confusion and ensures informed financial decisions.

Final Thoughts

February 2026 will bring a steady flow of federal deposits — tax refunds, Social Security benefits, and refundable credits — issued through normal processing channels. While the $2,000 figure may apply to certain individuals, it is not a guaranteed or universal payment.

Staying informed through official sources, filing accurately, and managing expectations responsibly remain the most effective strategies during tax season. In an environment where financial headlines spread quickly, clarity and verified information are your strongest assets.